Home »

Misc »

How much is a basketball team worth

How much is a basketball team worth

NBA team values: Knicks, Warriors, Lakers lead list of most valuable franchises for 2021-22 season

The NBA could see an ownership change before the end of the 2021-22 season.

Only hours ahead of Game 1 of the 2022 NBA Finals, ESPN's Adrian Wojnarowski reported that Nike founder Phil Knight and Dodgers part-owner Alan Smolinisky made an offer to purchase the Trail Blazers. Wojnarowski added that Knight and Smolinisky put more than $2 billion on the table.

Discussions of a potential sale are still ongoing with the Paul Allen Trust that's currently overseeing the franchise, per Wojnarowski. As Bleacher Report's Sean Highkin noted, an ownership change could be complicated because the NBA's Trail Blazers and the NFL's Seahawks are held in the trust rather than owned by an individual.

Jody Allen, sister to the late Paul Allen, is the Chair of Vulcan Inc., which consists of the Trail Blazers and Seahawks, among other assets. As the Trustee of the Paul Allen Trust, "Jody Allen is responsible for preserving and implementing Paul Allen's vision for generations to come.![]() "

"

While $2 billion seems like a massive number, the value of the Trail Blazers isn't even close to the estimated price tags of the top franchises in the league.

MORE: NBA's highest-paid players for 2021-22 NBA season

List of NBA team values for 2021-22 season

The Knicks ($5.8 billion), Warriors ($5.6 billion) and Lakers ($5.5 billion) each cleared the $5 billion mark on Forbes' latest list of the most valuable NBA franchises. Every team in the league is worth at least $1.5 billion, per Forbes' estimates.

The most recent sale of a franchise occurred when Alex Rodriguez and Marc Lore agreed to a $1.5 billion deal to buy the Timberwolves. They haven't taken full control of the team just yet, though, as their purchase is structured in installments.

(Per Forbes)

| Ranking | Team | Estimated value |

1. | Knicks | $5.8 billion |

| 2. | Warriors | $5.6 billion |

| 3. | Lakers | $5.5 billion |

| 4. | Bulls | $3.65 billion |

| 5. | Celtics | $3.55 billion |

| 6. | Clippers | $3.3 billion |

| 7. | Nets | $3.2 billion |

| 8. | Rockets | $2.75 billion |

| 9. | Mavericks | $2.7 billion |

| 10. | Raptors | $2.48 billion |

| 11. | 76ers | $2.45 billion |

| 12. | Heat | $2.3 billion |

| 13. | Trail Blazers | $2.05 billion |

| 14. | Kings | $2 billion |

| 15. | Spurs | $1.98 billion |

16. | Wizards | $1.93 billion |

| 17. | Bucks | $1.9 billion |

| 18. | Suns | $1.8 billion |

| 19. | Jazz | $1.75 billion |

| 20. | Nuggets | $1.73 billion |

| 21. | Hawks | $1.68 billion |

| 22. | Pacers | $1.67 billion |

| 23. | Cavaliers | $1.65 billion |

| 24. | Magic | $1.64 billion |

| 25. | Thunder | $1.63 billion |

| 26. | Pistons | $1.58 billion |

| 27. | Hornets | $1.575 billion |

| 28. | Timberwolves | $1.55 billion |

| 29. | Pelicans | $1.53 billion |

| 30. | Grizzlies | $1. 5 billion 5 billion |

List of NBA team owners

It's a great time to own an NBA team. While there were plenty of challenges during the seasons that took place amid the COVID-19 pandemic, the average value of an NBA franchise has only continued to jump.

Here is the owner or ownership group for each franchise.

(Per Forbes)

| Team | Owner |

| Knicks | Madison Square Garden Sports |

| Warriors | Joe Lacob, Peter Gruber |

| Lakers | Jerry Buss Family Trusts, Mark Walter, Todd Boehly |

| Bulls | Jerry Reinsdorf |

| Celtics | Wycliffe Grousbeck, Irving Grousbeck, Stephen Pagliuca, Robert Epstein |

| Clippers | Steve Ballmer |

| Nets | Joseph Tsai |

| Rockets | Tilman Fertitta |

| Mavericks | Mark Cuban |

| Raptors | Bell Canada, Rogers Communications, Larry Tanenbaum |

| 76ers | Joshua Harris, David Blitzer |

| Heat | Micky Arison |

| Trail Blazers | Paul G. Allen Trust Allen Trust |

| Kings | Vivek Ranadive |

| Spurs | Holt family, Sixth Street Partners |

| Wizards | Ted Leonsis |

| Bucks | Wes Edens, Marc Lasry, Jamie Dinan |

| Suns | Robert Sarver |

| Jazz | Ryan and Ashley Smith |

| Nuggets | Stan Kroenke |

| Hawks | Tony Ressler |

| Pacers | Herbert Simon, Stephen Simon |

| Cavaliers | Dan Gilbert |

| Magic | DeVos family |

| Thunder | Clayton Bennett, George Kaiser, Aubrey McClendon estate |

| Pistons | Tom Gores |

| Hornets | Michael Jordan |

| Timberwolves | Glen Taylor, Marc Lore, Alex Rodriguez |

| Pelicans | Gayle Benson |

| Grizzlies | Robert Pera |

Author(s)

New York Knicks Lead A Trio Now Worth Over $5 Billion Each

LeBron James' Los Angeles Lakers are now valued at $5. 5 billion, joining the New York Knicks and the Golden State Warriors in the $5 billion club.

5 billion, joining the New York Knicks and the Golden State Warriors in the $5 billion club.

Ringo HW Chiu/APThe average NBA team value has risen 13% since February, to $2.48 billion, behind record sponsorship revenue and high expectations for the league’s next media rights deal.

Despite a pandemic that kept arenas mostly empty during the 2020-21 season, the average value of an NBA franchise has risen 13%, to $2.48 billion, since Forbes’ last set of valuations, published in February.

For the first time, there are three NBA franchises worth more than $5 billion: the New York Knicks (No. 1, $5.8 billion), the Golden State Warriors (No. 2, $5.6 billion) and the Los Angeles Lakers (No. 3, $5.5 billion). These three teams play in the league’s biggest markets and under normal circumstances generate the most revenue because of their lucrative local television deals and arenas that produce piles of cash from luxury seating and advertising. (Click here for our full list of values and additional information on every team.)

(Click here for our full list of values and additional information on every team.)

Franchise investors are looking past the dearth of fans—which cut average revenue for the league’s 30 teams by 19% from the 2019-20 season, to $214 million—with eyes on a big rebound: An increase in sponsorship revenue coupled with fans returning to arenas this season should push the league’s revenue to an all-time high of at least $10 billion, 10% above the 2018-19 campaign, the last full season before the pandemic.

NBA owners booked an estimated $1.46 billion in sponsorships last season—a record—with much of the increase in this category coming from jersey patch deals. First introduced during the 2017-18 season and hovering about $150 million in total for the past couple of years, the agreements are expected to bring in well over $225 million across the league’s 30 teams in 2021-22. What began as nickel-and-dime advertising has rapidly increased into lucrative marketing agreements. For example, last month the Brooklyn Nets landed a jersey patch deal reportedly worth an NBA-record $30 million a year, one reason the value of the Nets rose 21% this year—more than any other team—to $3. 2 billion. Also in September, the Lakers and the Philadelphia 76ers inked patch deals reportedly worth $20 million and more than $10 million per year, respectively.

2 billion. Also in September, the Lakers and the Philadelphia 76ers inked patch deals reportedly worth $20 million and more than $10 million per year, respectively.

NBA Media Rights Fees Through The Years

Another reason for the jump is the high expectations for the next round of national media deals, which would begin with the 2025-26 season. The league currently gets an average of $2.66 billion a year from Walt Disney’s ABC and ESPN and AT&T’s Turner Broadcasting. Lee Berke, an expert in media rights, tells Forbes, “My projection is that the NBA’s media deals will double in value, thanks in part to a substantial boost in streamed content.”

No controlling interests of NBA teams have changed hands since our last ranking, but several minority stakes were sold at prices that show the franchises are a hot commodity, especially those in big markets.

According to people intimately familiar with these deals who spoke on the condition of anonymity, the implied enterprise value Marc Lore and Alex Rodriguez will pay for a controlling interest in the Minnesota Timberwolves is $1. 6 billion, with the deal expected to happen in three tranches by the end of 2023. Philip Anschutz sold his 27% stake in the Lakers in July at a $5 billion valuation, with an implied controlling stake valuation of around $5.5 billion; Forbes valued the team at $4.6 billion in February. The buyers, Mark Walter and Todd Boehley, have a path to eventually buying out controlling owner Jerry Buss Family Estate at some point in the future.

6 billion, with the deal expected to happen in three tranches by the end of 2023. Philip Anschutz sold his 27% stake in the Lakers in July at a $5 billion valuation, with an implied controlling stake valuation of around $5.5 billion; Forbes valued the team at $4.6 billion in February. The buyers, Mark Walter and Todd Boehley, have a path to eventually buying out controlling owner Jerry Buss Family Estate at some point in the future.

Non-Controlling Stake Sales Since February 2021

Other, smaller pieces of teams where the buyers obtained no path toward control also changed hands at prices above our last edition of NBA valuations. Arctos Sports Partners nabbed a 17% stake in the Sacramento Kings at a $1.84 billion valuation last month, just above our February estimate of $1.825 billion. The private equity firm also bought just under 5% of the Golden State Warriors at a $5.5 billion valuation in April, the high-water mark for a minority stake and 17% above our last estimate.

Additional research by Justin Teitelbaum.

Gallery: The NBA's Highest-Paid Players 2021-22

10 images

View gallery

The NBA’s Most Valuable Teams G Fiume getty Images

• Value: $5.8 billion

• 1-Year Change: 16%

• Owner: Madison Square Garden Sports

• Operating Income: $71 million

• Value: $5.6 billion

• 1-Year Change: 19%

• Owners: Joe Lacob, Peter Guber

• Operating Income: –$44 million

• Value: $5.5 billion

• 1-Year Change: 20%

• Owners: Jerry Buss Family Trusts, Mark Walter, Todd Boehly

• Operating Income: $63 million

• Value: $3. 65 billion

65 billion

• 1-Year Change: 11%

• Owner: Jerry Reinsdorf

• Operating Income: $39 million

Kathy Willens/AP

• Value: $3.55 billion

• 1-Year Change: 11%

• Owners: Wycliffe Grousbeck, Irving Grousbeck, Stephen Pagliuca, Robert Epstein

• Operating Income: $46 million

• Value: $3.3 billion

• 1-Year Change: 20%

• Owner: Steve Ballmer

• Operating Income: $18 million

• Value: $3.2 billion

• 1-Year Change: 21%

• Owner: Joseph Tsai

• Operating Income: –$80 million

• Value: $2.75 billion

• 1-Year Change: 10%

• Owner: Tilman Fertitta

• Operating Income: $33 million

• Value: $2. 7 billion

7 billion

• 1-Year Change: 10%

• Owner: Mark Cuban

• Operating Income: $55 million

Cole Burston/getty images

• Value: $2.48 billion

• 1-Year Change: 15%

• Owners: Bell Canada, Rogers Communications, Larry Tanenbaum

• Operating Income: $2 million

• Value: $2.45 billion

• 1-Year Change: 18%

• Owners: Joshua Harris, David Blitzer

• Operating Income: $13 million

• Value: $2.3 billion

• 1-Year Change: 15%

• Owner: Micky Arison

• Operating Income: $16 million

• Value: $2.05 billion

• 1-Year Change: 8%

• Owner: Paul Allen estate

• Operating Income: $19 million

• Value: $2 billion

• 1-Year Change: 10%

• Owner: Vivek Ranadivé

• Operating Income: $22 million

Ronald Cortes/getty imges

• Value: $1. 98 billion

98 billion

• 1-Year Change: 7%

• Owners: Holt family, Sixth Street Partners

• Operating Income: $39 million

• Value: $1.93 billion

• 1-Year Change: 7%

• Owner: Ted Leonsis

• Operating Income: $14 million

• Value: $1.9 billion

• 1-Year Change: 17%

• Owners: Wes Edens, Marc Lasry, Jamie Dinan

• Operating Income: $11 million

• Value: $1.8 billion

• 1-Year Change: 6%

• Owner: Robert Sarver

• Operating Income: $15 million

• Value: $1.75 billion

• 1-Year Change: 5%

• Owners: Ryan & Ashley Smith

• Operating Income: $96 million

Joe Mahoney/AP

• Value: $1. 73 billion

73 billion

• 1-Year Change: 5%

• Owner: Stan Kroenke

• Operating Income: $15 million

• Value: $1.68 billion

• 1-Year Change: 11%

• Owner: Tony Ressler

• Operating Income: $37 million

• Value: $1.67 billion

• 1-Year Change: 8%

• Owners: Herbert Simon, Stephen Simon

• Operating Income: $460,000

• Value: $1.65 billion

• 1-Year Change: 6%

• Owner: Dan Gilbert

• Operating Income: $11 million

• Value: $1.64 billion

• 1-Year Change: 12%

• Owner: DeVos family

• Operating Income: $29 million

• Value: $1.63 billion

• 1-Year Change: 3%

• Owners: Clayton Bennett, George Kaiser, Aubrey McClendon estate

• Operating Income: $48 million

Brandon Dill/AP

• Value: $1. 58 billion

58 billion

• 1-Year Change: 9%

• Owner: Tom Gores

• Operating Income: $43 million

• Value: $1.575 billion

• 1-Year Change: 5%

• Owner: Michael Jordan

• Operating Income: $34 million

• Value: $1.55 billion

• 1-Year Change: 11%

• Owners: Glen Taylor, Marc Lore, Alex Rodriguez

• Operating Income: $29 million

• Value: $1.53 billion

• 1-Year Change: 13%

• Owner: Gayle Benson

• Operating Income: $24 million

Justin Ford/getty images

• Value: $1.5 billion

• 1-Year Change: 15%

• Owner: Robert Pera

• Operating Income: $12 million

METHODOLOGYRevenue and operating income (earnings before interest, taxes, depreciation and amortization) are for the 2020-21 season and are net of revenue sharing and arena debt service. We use revenue multiples to calculate our team values (equity plus net debt) based on the economics of each team’s current arena deal. If a team has a new arena, media deal or sponsorship agreement set to open or kick in after the 2020-21 season, we estimate its impact on the enterprise value. For example, the value of the Los Angeles Clippers is $3.3 billion, 20% more than in our NBA valuations in February, in part because the team has broken ground on a new arena that is expected to significantly increase the team’s revenue. Our figures include revenue that team owners get from non-NBA events at their arena. All figures are in U.S. dollars based on the average U.S.-Canada exchange rates during the 2020-21 season. The information used to compile our valuations primarily came from the teams, sports bankers, media consultants and public documents, like arena lease agreements and bond documents.

We use revenue multiples to calculate our team values (equity plus net debt) based on the economics of each team’s current arena deal. If a team has a new arena, media deal or sponsorship agreement set to open or kick in after the 2020-21 season, we estimate its impact on the enterprise value. For example, the value of the Los Angeles Clippers is $3.3 billion, 20% more than in our NBA valuations in February, in part because the team has broken ground on a new arena that is expected to significantly increase the team’s revenue. Our figures include revenue that team owners get from non-NBA events at their arena. All figures are in U.S. dollars based on the average U.S.-Canada exchange rates during the 2020-21 season. The information used to compile our valuations primarily came from the teams, sports bankers, media consultants and public documents, like arena lease agreements and bond documents.

Get Forbes’ daily top headlines delivered straight to your inbox for news on the world’s most important entrepreneurs and superstars, expert career advice and success secrets.

The most expensive NBA clubs - 2020. Forbes rating

Despite a series of informational scandals, the NBA remains an attractive business for club owners. The 2019 league will be remembered, among other things, thanks to the deal for the sale of shares in the Brooklyn Nets by Mikhail Prokhorov. The tragic death of league legend Kobe Bryant, a drop in TV ratings, and a quarrel with the Chinese authorities over the support of protests in Hong Kong by the general manager of the Houston Rockets, Daryl Morey, all these informational reasons do not add optimism to fans. Not to mention the conflict between the owner and the fans of the most expensive NBA team, the New York Knicks, which is why the team's series of failures has been dragging on for the seventh year in a row.

Farewell legend: Kobe Bryant's life on and off the court

However, according to Forbes, the basketball business is at its peak. The capitalization of the NBA franchise continues to grow: over the past year, the total value of the clubs in the league has increased by 14%. On average, an NBA team is valued at $2.12 billion today. For comparison, National Football League clubs have risen in price by 11% over the year, to an average of $2.86 billion, and Major League Baseball by 8%, to $1.78 billion. decade, the cost of NBA teams has increased almost sixfold.

The league's 30 clubs generated a record $8.8 billion in revenue last season, up 10% from a year earlier. In the current season, the figures will also grow. Ticket revenues are expected to increase by 8%. In addition, the opening of the new Golden State Warriors arena in San Francisco and the restoration of existing arenas in Boston, Cleveland, Philadelphia and Washington DC will contribute to revenue growth.

"The NBA's fundamentals are still strong and the league is now run very efficiently," said Sal Galatioto, president of consulting firm Galatioto Sports Partners. “There were a couple of hiccups, but the matches remain a great spectacle for the fans and basketball remains the most popular sport in the world after football.”

2019 was marked by two major deals. Back in 2018, Alibaba co-founder Joseph Tsai agreed to buy the Brooklyn Nets team for $2.35 billion over three years, but then, in August 2019, he added the Barclays Center arena in Brooklyn to the parameters of the agreement. . The total amount of the transaction reached $3.3 billion. Hornets" to investors Gabe Plotkin and Daniel Sandheim. As part of the agreement, the team was valued at $1.5 billion, although in 2010, when Jordan bought control of the club, the amount was only $175 million.

The basketball business is not without factors off the court. With the S&P index up 80% over the past five years, NBA sports teams remain an asset diversification option for those who want to cut back on equities. Prices for clubs are rising following the stock market.

With the S&P index up 80% over the past five years, NBA sports teams remain an asset diversification option for those who want to cut back on equities. Prices for clubs are rising following the stock market.

Buying a team can also be a great opportunity for a tax holiday: under US law, owners of such assets have a 15-year tax grace period.

According to Forbes, the New York Knicks are losing ground for the fifth year in a row at the top of the rankings. Their revenue grew 15% in the reporting period and their value rose to $4.6 billion. They are immediately followed by the Los Angeles Lakers with $4.4 billion and the Golden State Warriors with $4.3 billion. These three teams can boast the highest earnings in the NBA. When other North American sports franchises are taken into account, the New York Knicks are only valued by the $5.5 billion National Football League (NFL) Dallas Cowboys. Los Angeles Lakers and Golden State Warriors behind another non-basketball club, the $4. 6 billion Major League Baseball (GLB) New York Yankees.

6 billion Major League Baseball (GLB) New York Yankees.

Characteristically, sports teams in New York and Los Angeles are transferred to new owners for amounts that are many times their revenue. So, in 2014, Steve Ballmer laid out 14 annual club revenues for the Los Angeles Clippers, and Tsai for the Brooklyn Nets - 11. Tilman Fertitta, when buying the Houston Rockets in 2017, offered the former owner only 7 times more than the team's annual income.

The average basketball team is valued at more than $2 billion for the first time, even though in 2011 no league franchise was worth more than $1 billion.

| Club | Cost, $ million | Growth compared to last year, % |

| "New York NIX" | 4 600 | 15 |

| Leos-Andigles Leykels Leyers " | 4 400 | 19 |

| "Golden Stayt Warriorz" | 4 300 | 23 |

| "Chicago Bulls" | 9005 10 9003 9003 9003 | "BOSTENS" BOSTEN "" "0052 3 100 | 11 |

| “Los Angeles Clippers” | 2 600 | 18 |

| “Brooklyn Nets” | 2 500 | 6 | “Khouston Rocks” | 8 |

| Dallas Maveriks | 2 400 | 7 |

| “Toronto Raptors” | 2 100 |

000 9000. very lucky. They made good money with a $24 billion contract to broadcast NBA games on TNT and ESPN. The collaboration began in the 2016/2017 season, and profits are evenly distributed among all 30 teams.

very lucky. They made good money with a $24 billion contract to broadcast NBA games on TNT and ESPN. The collaboration began in the 2016/2017 season, and profits are evenly distributed among all 30 teams. Another important incentive was the collective agreement signed in 2011. From 57% to 51%, the share of payroll in the structure of clubs' income decreased, which ensured the growth of profits for all teams. Last season, each club's average operating income increased 15% to $70 million. Half a dozen teams earned at least $100 million, while the Oklahoma City Thunder was the only one to go into the red with a loss of $23 million, all from -for paying a $61 million tax on whopping player fees.

While only two clubs have changed ownership in the past four years, the NBA's audience and the franchise's prospects for foreign markets make team acquisitions an attractive investment in the eyes of potential buyers. However, while the NFL matches remain the most popular sports spectacle in the United States, and any other professional league can only envy such TV ratings. In 2019, 41 of the 50 most watched TV broadcasts came from football matches.

In 2019, 41 of the 50 most watched TV broadcasts came from football matches.

But don't forget that in recent years, watching sports has increasingly gravitated towards streaming services, which means that a younger audience will be the key to the development of the NBA. According to the Nielsen analytical agency, the average age of the NBA viewer is 43 years old, while NFL and GLB games are of interest to older people - 52 and 59 years old, respectively. The popularity of the NBA on streaming platforms has increased by 30% this season.

Lee Burke, CEO of consulting firm LHB Sports, explains: “This season, the NBA's ratings are getting kind of silly. The sampling is carried out on a limited layer of viewers. The NBA is a year-round league with something going on all the time. The following streaming agreements will undergo significant changes due to streaming services. There will be more media companies that want to show NBA games in the US and other countries. ” The current deal with ESPN and TNT, worth $2.7 billion a year, expires in the 2024/2025 season, and Burke predicts a new deal worth twice that amount.

” The current deal with ESPN and TNT, worth $2.7 billion a year, expires in the 2024/2025 season, and Burke predicts a new deal worth twice that amount.

In a recent survey of 2,000 sports business executives, MarketCast was able to identify Americans' favorite sports and rank them by age group. The NFL is more popular with fans aged 35 and over and has a 10:1 lead over the NBA. But the NBA is more often preferred by viewers from 18 to 34 years old (41% vs. 38%), and those who are from 13 to 17 simply adore - in this group, the NBA leads with a figure of 57%, the NFL is far behind with 13%. As for GLB, it scored a modest 4% among teenagers.

The potential in the international market also favorably distinguishes the NBA from competitors who mainly work for the American public. The NBA can be watched in 215 countries, and its players include many athletes from all over the world. Last season, the roster of players included 108 players from 38 countries and territories, with a number of them being named MVP (Giannis Antetokounmpo), Defensive Player of the Year (Rudy Gobert), Rookie of the Year (Luka Doncic) and Most Improved Player ( Pascal Siakam).![]()

In addition, China remains an important market for the future of the NBA, especially after a $1.5 billion deal with Tencent last summer. The league is working hard to improve relations with Chinese TV and sponsoring partners, but the situation is constantly changing. Most executives believe that Daryl Morey's position will not interfere with the long-term development of the NBA's business in China.

Income and earnings before interest, taxes, depreciation and amortization are calculated for the 2018/2019 seasonnet of income distribution and arena debt servicing. To calculate the club's value (asset value plus net debt), annual revenue ratios are applied based on the financial terms of each team's current arena agreement. The Forbes valuation is the estimated amount for which the club would be put up for sale. So even though Joseph Tsai paid $3.3 billion for the Brooklyn Nets, we believe the team is worth $2.5 billion because he paid approximately $1 billion for the loss-making arena maintenance business. If the club has a new arena, content distribution deals or sponsorship agreements that take effect at the end of the 2018/2019 season, we assessed their impact on the value of the business. Our profitability and franchise value estimates also include the earnings that team owners make from the arena through non-NBA events.

If the club has a new arena, content distribution deals or sponsorship agreements that take effect at the end of the 2018/2019 season, we assessed their impact on the value of the business. Our profitability and franchise value estimates also include the earnings that team owners make from the arena through non-NBA events.

Translation by Anton Bundin

How the NBA started making billions of dollars with David Stern

David Stern, the former commissioner of the US National Basketball Association (NBA), died on January 1st. He led the NBA for 30 consecutive years from 1984 to 2014.

His marketing talent and business sense helped to pull the association out of existence, and make basketball players the same world stars as football players and millionaires.

Before Stern's appointment as Commissioner, it seemed very real that the NBA would disappear. This basketball association looked very faded against the backdrop of the leagues of American football and baseball. And when Stern retired in 2014, the NBA had annual revenues of $5.5 billion, its broadcast revenues had grown 40 times over $1 billion in 30 years. The NBA had offices in 15 cities outside the United States. Her games have been broadcast in over 200 countries in over 40 languages. Compare for yourself: how much do you know about American football or baseball, but how much about American basketball?

And when Stern retired in 2014, the NBA had annual revenues of $5.5 billion, its broadcast revenues had grown 40 times over $1 billion in 30 years. The NBA had offices in 15 cities outside the United States. Her games have been broadcast in over 200 countries in over 40 languages. Compare for yourself: how much do you know about American football or baseball, but how much about American basketball?

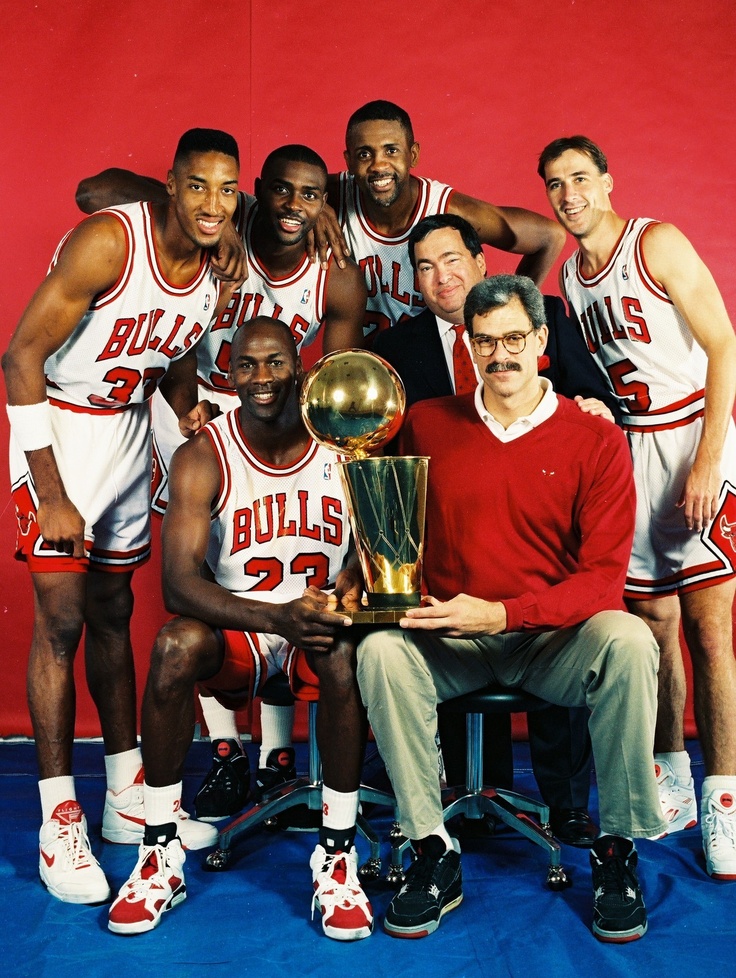

The attractiveness of business for investors has also grown. Shortly after Stern's arrival, the Chicago Bulls were sold for $16 million. And after 30 years of his work, the Los Angeles Clippers changed hands for $2 billion. Salaries also increased. The famous basketball player Charles Barkley recalled that in 1984 the average salary of players was $250,000. Now it is almost $9 million. He broke the record of the head of the National Football League, Pete Rozelle, for a year (1960–1989).

From deli to basketball

David Joel Stern was born on September 22, 1942 in Manhattan (New York, USA). His father ran the family's deli, Stern's Deli, where all three of his children worked from childhood. Stern chose a profession far from both trade and sports. First he received a degree in history from the prestigious Rutgers University (New Jersey). Then - a law degree from Columbia University. In 1966 he joined the law firm Proskauer, Rose, Goetz & Mendelsohn.

His father ran the family's deli, Stern's Deli, where all three of his children worked from childhood. Stern chose a profession far from both trade and sports. First he received a degree in history from the prestigious Rutgers University (New Jersey). Then - a law degree from Columbia University. In 1966 he joined the law firm Proskauer, Rose, Goetz & Mendelsohn.

David's parents divorced when he was young. Like his father, he became a fan of the New York Knicks basketball team and often went to games with his dad.

Stern himself played for a while, and played well. His height was not basketball - about 176 cm (although, according to the sports website ESPN, he still turned out to be taller than the leaders of other US national sports leagues). “I played for my law firm's team in the New York Lawyers Basketball League. And it cost me most of the cartilage in my right knee,” Stern joked in an interview with The New York Times (NYT).

Being a basketball player is more profitable than being a football player

In the 2019/20 season, Steph Curry, defenseman for the Golden State Warriors, should receive the largest reward among NBA players - $ 40. 2 million (the reward is calculated from the forecast of income from basketball activities and is subject to adjustment at the end of the season), writes the author of the blog in Sports.ru. But even, for example, the 51st number in the NBA rating Malcolm Brogdon from the Indiana Pacers (Indianapolis) should receive $ 20 million. That is, he earns more than such football stars as the striker of the English Manchester City and Argentina national team Sergio or the goalkeeper and captain of the German Bayern München and the German national team Manuel Neuer. Brogdon's name doesn't mean much to the average person, and he's not the only one in the NBA: according to the rules of the NBA, based on its projected income, 51 players should receive at least $20 million this season.

2 million (the reward is calculated from the forecast of income from basketball activities and is subject to adjustment at the end of the season), writes the author of the blog in Sports.ru. But even, for example, the 51st number in the NBA rating Malcolm Brogdon from the Indiana Pacers (Indianapolis) should receive $ 20 million. That is, he earns more than such football stars as the striker of the English Manchester City and Argentina national team Sergio or the goalkeeper and captain of the German Bayern München and the German national team Manuel Neuer. Brogdon's name doesn't mean much to the average person, and he's not the only one in the NBA: according to the rules of the NBA, based on its projected income, 51 players should receive at least $20 million this season.

His work as a lawyer also turned out to be related to sports. Proskauer, Rose, Goetz & Mendelsohn represented the NBA. Stern has been involved in several high-profile cases, including a 1970 antitrust lawsuit in which NBA player union president Oscar Robertson interfered with the NBA's merger with rival American Basketball Association (ABA). As a result, the merger had to be postponed for six years - the case in court dragged on until 1976. It had other important consequences. For example, before the players were actually serfs of the club: they did not have the right to negotiate a transfer to another team, at the same time they could be fired at any time.

As a result, the merger had to be postponed for six years - the case in court dragged on until 1976. It had other important consequences. For example, before the players were actually serfs of the club: they did not have the right to negotiate a transfer to another team, at the same time they could be fired at any time.

How Stern increased the competition

In 1978, Stern was lured to the NBA, where he became general counsel. Then the post of vice president was created for him. In addition to resolving legal issues, he was responsible for marketing, PR, negotiations with television companies and much more.

The NBA star was waning in those years. In the 1980/81 season, out of 23 teams, 16 were unprofitable. The finals of the games were often not live, but recorded, and at an unpopular time - at 23.30. At 1980 a drug scandal erupted. An article in The Los Angeles Times claimed that 40 to 75% of gamblers use cocaine. The press then wrote about the NBA as an association overflowing with black players and drug addicts, Stern recalled in a conversation with ESPN. As vice president, he entered into negotiations with NBA member clubs to introduce anti-drug tests before games. The NBA was the first sports league in North America to implement this innovation.

As vice president, he entered into negotiations with NBA member clubs to introduce anti-drug tests before games. The NBA was the first sports league in North America to implement this innovation.

In 1984, Stern took over the NBA. Other candidates were not even considered. He was number two in the NBA for several years, and his appointment seemed like a no-brainer. One of his first steps was to help small clubs. Restrictions were introduced on the size of the players' pay fund, which was tied to income from basketball activities (BRI, basketball-related income), and, accordingly, it is different every year. The first time it was $3.8 million per team (in the 2018/19 season- $ 109.14 million, according to the Sports.ru blog dedicated to salaries in the NBA). This somewhat equalized rich and poor clubs—the rich could no longer buy up all the stars who needed to be paid a lot—and led to a new round of rivalry between the Boston Celtics and the Los Angeles Lakers, which seemed to have faded back in 1969.

Now the system of remuneration of players is arranged according to the principle of soft and hard ceiling, so it is permissible to exceed the originally announced limit. But there is an amount starting from which the NBA will have to pay the so-called "luxury tax" - in the 2018/19 seasonthe tax threshold was set at $132.627 million. And, finally, there is a hard ceiling that cannot be broken under any pretext: in the season just ended it is $138.928 million.

club owners to find a compromise regarding remuneration: basketball players received the right to 53% of the income.

People, not teams

Current NBA Commissioner Adam Silver says Stern was among the founders of modern sports marketing - "one of the people who took modern marketing techniques and applied them to the sports league."

He founded the licensing and sponsorship division of the NBA. Together with its director, he compiled a “dream list” of NBA partners (McDonald’s, Coca-Cola, etc. ) and went on a trip around the country to persuade them to cooperate.

) and went on a trip around the country to persuade them to cooperate.

While still a VP, Stern helped launch NBA Entertainment's basketball-related content division. And becoming a commissioner, he expanded the staff, agreed with video game manufacturers, and in the end, with his participation, a hit appeared - a series of sports simulators NBA Jam (the first came out at 1993).

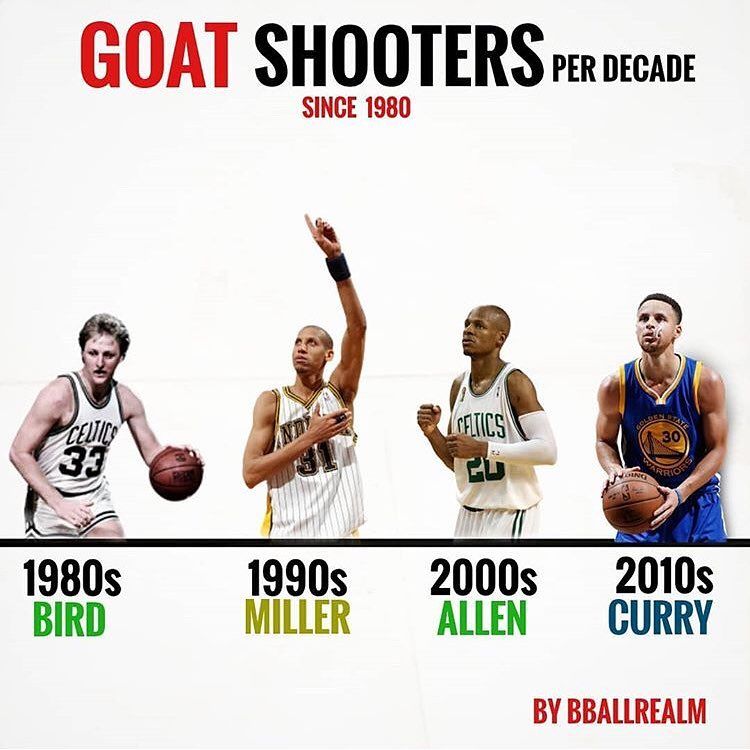

He decided to promote star players rather than whole teams. If in the 1960s the rivalry between the Boston Celtics and the Los Angeles Lakers was a battle of clubs, then under Stern it became the confrontation between Magic Johnson and Larry Bird. Stern's other star was Michael Jordan, who joined the Chicago Bulls in 1994.

In his first year as Commissioner, Stern sold the rights to broadcast NBA games to an Argentinean television station for a ridiculous $2,000 a year. Every Sunday in a country where children dreamed of football, they showed that the ball can be dribbled with their hands. And it has borne fruit. When Argentinean Emanuel Ginobili was a child, he looked at Michael Jordan and thought he was from another planet. Since then, Ginobili has won the NBA championship four times with the San Antonio Spurs, although there had not been a single one of his compatriots in the league before.

And it has borne fruit. When Argentinean Emanuel Ginobili was a child, he looked at Michael Jordan and thought he was from another planet. Since then, Ginobili has won the NBA championship four times with the San Antonio Spurs, although there had not been a single one of his compatriots in the league before.

Women, Greek and Canadian

David Stern added seven new teams to the NBA for a total of 30. The NBA Women's League was born in 1997 and the NBA minor league for the G League farm clubs in 2001. According to Stern, we need to work with young talents so that there are as many boys and girls as possible who “will start to dribble the ball with their hands instead of kicking it.” The

NBA was a purely American league. And now the title of its most valuable player is Giannis Antetokounmpo, a Greek born to Nigerian immigrants, and the NBA champion is the Canadian team Toronto Raptors with players from three continents.

In 1989, Stern waited four hours in Beijing to meet Chinese CCTV representatives, then persuaded them to broadcast the games for free. Now 18 million people watch the NBA games in China, and last year the Chinese Tencent and the NBA announced a five-year contract for $1.5 billion.

Now 18 million people watch the NBA games in China, and last year the Chinese Tencent and the NBA announced a five-year contract for $1.5 billion.

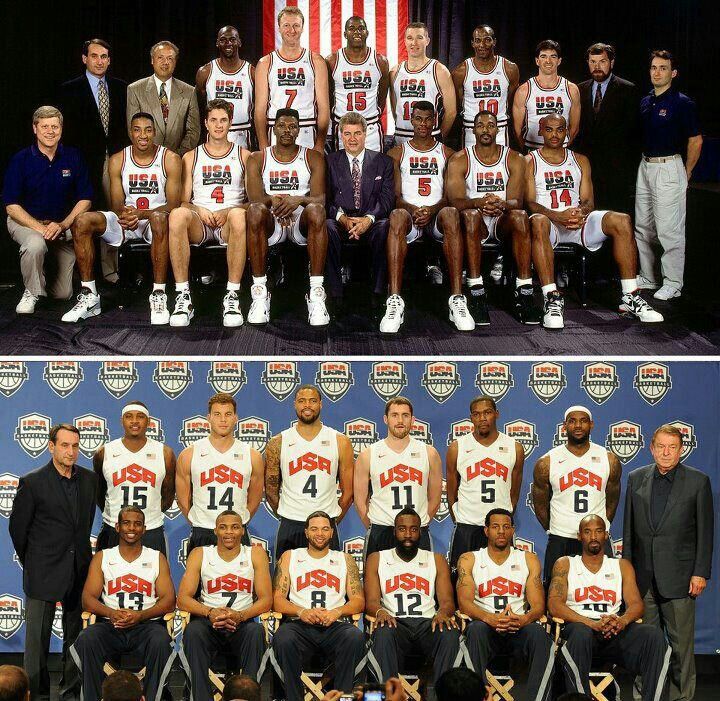

NBA - and defeated all rivals. That team was called the dream team, and upon their return they were honored, as Stern told the NYT, as if it were the Bolshoi Theater, the Philharmonic and The Beatles put together. “The dream team ignited interest in basketball around the world,” Stern recalled ESPN last year. – Before the Olympics-92 NBA games were shown in about 80 countries, today - in 215.

The following fact testifies to Stern's attitude towards the players. In 1991, Magic Johnson announced that he had HIV and was retiring from playing. The disease in those days caused irrational fear and disgust in society. Some did not want to play on the same site with Johnson, for fear of getting infected through scratches. But Stern launched a whole campaign of tolerant attitude towards HIV patients - doctors came to the players and talked about the disease. He insisted that Johnson not be crossed off the voting lists for the most outstanding player of the season - and he earned the award. The photo of Stern presenting the prize to Johnson was posted by the NBA commissioner in a prominent place in his office. He also pushed for Johnson to be included in the Olympic Dream Team.

He insisted that Johnson not be crossed off the voting lists for the most outstanding player of the season - and he earned the award. The photo of Stern presenting the prize to Johnson was posted by the NBA commissioner in a prominent place in his office. He also pushed for Johnson to be included in the Olympic Dream Team.

Stern soft and hard

Stern liked to call himself Easy Dave, which can be translated as "easy Dave" and "easily inferior Dave." But among those around him, he earned a reputation as a tyrant. In 2005, Stern became concerned about the image of the players and introduced a dress code. At official NBA events, they were ordered to adhere to a business style, abandoning shorts, wide pants, massive chains, bandanas and other attributes of gangsters and hip-hop fans.

This sparked strong protests from players, fans and even African American rights activists. The dress code was clearly infringing on the style that black players were used to. However, it brought a positive effect, Sports.ru noted: basketball players thought about their appearance, hired stylists, and developed their own style of dress. And, as a result, articles about their life outside the basketball court began to appear more often in the media.

However, it brought a positive effect, Sports.ru noted: basketball players thought about their appearance, hired stylists, and developed their own style of dress. And, as a result, articles about their life outside the basketball court began to appear more often in the media.

Dress code - yes, it has entered the life of the players. But in another important issue, Stern did not succeed in insisting on his own. In the 2006/07 season, he introduced synthetic turf balls into the game, despite the dissatisfaction of the players: after test drives, they complained that the ball rebounded differently from the floor. Already in December 2006, it was necessary to announce that the NBA was returning to the good old leather balls.

Stern was not soft on the guilty. Latrell Sprewell was suspended for the entire season-19 for assaulting a coach during training97/98 - 82 games. In court, Sprewell's lawyer managed to reduce this period to 68 games, for which the NBA legal counsel received a severe scolding from Stern.

In 2004, during a match, the Detroit Pistons and Indiana Pacers teams fought - first with each other, and then with the audience. Nine players were suspended for a total of over 100 matches without pay, which resulted in a loss of about $11 million. “We couldn't let the barrier between players and fans break down. This would deprive us of the most accessible game in the world, where you could literally sit on the edge of the court and almost touch the players running past, ”Stern explained. But at the same time, he visited the family of Indiana Pacers player Ron Artest, who was suspended for as many as 86 games at his insistence, and helped his sick relatives get the necessary medical care.

He also interfered in the affairs of teams. In 2011, he banned New Orleans from trading players. For many years, Stern explained this decision briefly in all interviews: “It was in the interests of basketball.” And only two years ago, already retired, he condescended to details: “I offered the best option <. ..> But [Dell, who was in charge at that time of New Orleans] Demps, turned out to be a lousy general manager” (quoted from Championat.com). What is a lockout? . The first lockout began in the summer of 1995 and stretched out for two months, but ended before the start of the season. Only the summer fees suffered. The second lockout lasted only three hours in 1996. The third lasted from July 1998 to January 1999, due to which the start of the season had to be postponed and the number of games in it was reduced from 82 to 50. The last one was from July to December 2011 ., due to which the season was reduced to 66 games.

..> But [Dell, who was in charge at that time of New Orleans] Demps, turned out to be a lousy general manager” (quoted from Championat.com). What is a lockout? . The first lockout began in the summer of 1995 and stretched out for two months, but ended before the start of the season. Only the summer fees suffered. The second lockout lasted only three hours in 1996. The third lasted from July 1998 to January 1999, due to which the start of the season had to be postponed and the number of games in it was reduced from 82 to 50. The last one was from July to December 2011 ., due to which the season was reduced to 66 games.

Player income was the key issue. For example, during the 1996 three-hour lockout, basketball players demanded more TV revenue, and the NBA agreed to increase payouts by a compromise amount.

Stern represented club owners during the lockouts who wanted to save money on players, but played more of an intermediary role. Reviews about him were mixed. Stern threatened the players. “I know where the bodies are buried in the NBA — I personally buried some there,” he said, appearing in the locker room of the basketball players during Star Weekend. True, the cases of his revenge were unknown to anyone, ESPN assures: he was an explosive person, but quick-witted.

“I know where the bodies are buried in the NBA — I personally buried some there,” he said, appearing in the locker room of the basketball players during Star Weekend. True, the cases of his revenge were unknown to anyone, ESPN assures: he was an explosive person, but quick-witted.

"You can't be too nice a guy"

In 1986, just two years after his appointment as commissioner, David Stern interviewed former basketball player Rod Thorne for the position of vice president in charge of discipline. "They say you're a nice guy," Stern said thoughtfully. “Well, at our job, you can’t be too nice a guy.” “There was nothing soft about him,” recalled Thorne, who was hired and served as vice president of the NBA for 14 years. He expected you to do your job. And if not, he will not hesitate to tell you about it. From time to time I listened to similar things, sometimes in very harsh terms. But most of the time [Stern] was right." Stern loved to arrange mini-exams: ask his subordinates questions, the answers to which he knew, and if they found it difficult to answer, he gave them a dressing down.

One of the top managers of the NBA admitted that he left his job many times with the thought of being fired. But at 10 p.m., Stern called, talking about new goals and how great it would be when they were achieved: “And I was ready to go through walls for Stern.”

The permanent commissar was forgiven a lot for his ability to ignite people, and for his ability to foresee the future of sports, and for the fact that he gushed with ideas. For example, in the 1990s a subordinate gave him the idea of holding a press conference about a new deal with Coca-Cola, showing clips on video screens. Stern immediately ordered to figure out how to organize an event in a cinema: on a huge screen, the commercials would look unbelievably better. “You walk into his office thinking you've thought of everything,” the subordinate concluded. “And he says something that didn’t occur to you - and, damn it, he’s right!”

Sociologist Harry Edwards, who studies the characteristics of African American athletes, assured that Stern's reputation among the players only strengthened as a result of negotiations. But HBO sportswriter Bryant Gumbel called him egocentric and compared his negotiating tactics to the diplomacy of a plantation overseer. Stern himself, many years later, having already retired from the NBA commissioners, publicly responded to Gumbel: he called him an “idiot” in an interview with The Washington Post - another touch to his harsh character.

But HBO sportswriter Bryant Gumbel called him egocentric and compared his negotiating tactics to the diplomacy of a plantation overseer. Stern himself, many years later, having already retired from the NBA commissioners, publicly responded to Gumbel: he called him an “idiot” in an interview with The Washington Post - another touch to his harsh character.

Season 19 lockout98/99 ended with the victory of the owners of the clubs, who set the maximum salary cap they needed for players, mainly due to Stern's actions, wrote the NYT. He sowed distrust between the players and agents, so that the athletes no longer knew who to listen to.

During the 2011 lockout, club owners were able to increase their share from 43% to 50% of revenues.

But even Stern's opponents recognized his merits. “Stern realized that the game is about the players, and raised their market appeal to such heights as never before,” said lawyer Jeff Kessler, who represented the union in numerous battles with Stern. “He was a worthy adversary and sometimes a pain in the ass, but I loved him despite all the difficulties.”

“He was a worthy adversary and sometimes a pain in the ass, but I loved him despite all the difficulties.”

Commissioner farewell

As NBA commissioner, Stern earned about $9 million a year, according to ESPN. In February 2014, he retired and could have lived an idle and comfortable life. But he is a natural workaholic. He actively advised his successor, taking the post of honorary commissioner of the NBA. He has served as an advisor to investment bank PJT Partners, venture capital firm Greycroft Partners, consulting business PricewaterhouseCoopers, and a number of other smaller firms.

Last November, Thorne, a former NBA vice president, and his wife dined with Stern and his wife. He was in good health and in excellent spirits. But on December 12, Stern suffered a stroke and emergency surgery, which, unfortunately, could not save his life. On January 1, he died at the age of 78. Shortly before his death, he was asked what he would have done differently in the NBA if he had had a chance to work those 30 years as commissioner again.